Financial Aid: From Start to Finish

Welcome to Stockton University!

We understand how important the financial aid process is and we're here to help.

Explore the links below to learn more about the financial aid process from start to finish.

Apply for Aid

After You've Applied

Be sure to complete each task below to ensure your financial aid is processed.

After receiving a student's FAFSA, the Office of Financial Aid offers aid to new students.

*Returning students receive an aid offer the summer before the Fall term and after all requirements are completed.

Students will receive an email notifying them when their financial aid offer is ready to view. A link to view their offer notification is provided within the email.

View the instructional video to the right to learn how to view your financial aid offer as well as for a detailed overview of the offer.

Instructional Video:

After viewing your personalized financial aid offer for attendance at Stockton University, you can take action on your offer through the goStockton Portal.

Grants and scholarships are accepted on behalf of the student, so you do not need to accept or decline these. You can take action on federal direct loans through the portal.

Accept Your Offer

Instructional Video:

If you have decided to accept Federal Direct Loans, you are required to complete Entrance Counseling and a Master Promissory Note (MPN) on studentaid.gov.

Failure to complete these requirements could result in a delay in the processing of aid.

Once these requirements are completed, the school will receive the information from the federal government within 3-5 business days. Once we have received the information, the requirements will show as satisfied on the student's account.

Complete Entrance Counseling

Complete a Master Promissory Note (MPN)

Federal Verification

Once a student files the FAFSA, they may be randomly selected by the U.S. Department of Education, for review in a process called Verification. Stockton University is required by federal regulations to verify the accuracy of the information reported on the student's application.

In order to comply with these regulations, we may need to collect additional documentation and/or have the student transfer data from the Internal Revenue Service (IRS) into the FAFSA.

Our office sends weekly emails to students notifying them of their outstanding requirements. Students can view their requirements through the goStockton portal.

View Your Requirements

Instructional Video:

Learn more about how to complete verification requirements at stockton.edu/verification.

After we receive all required documents and information, you will receive a confirmation email confirming that you have submitted all required documents. Then, we will review your account. After reviewing the information, we may determine that we need to collect additional documentation or information. If we need anything additional, we will send you an email. Check your goStockton email regularly for updates.

Once the verification process is completed, you will receive a notification and will be offered all financial aid for which you are eligible. Learn the next steps at stockton.edu/fafsa.

State Verification

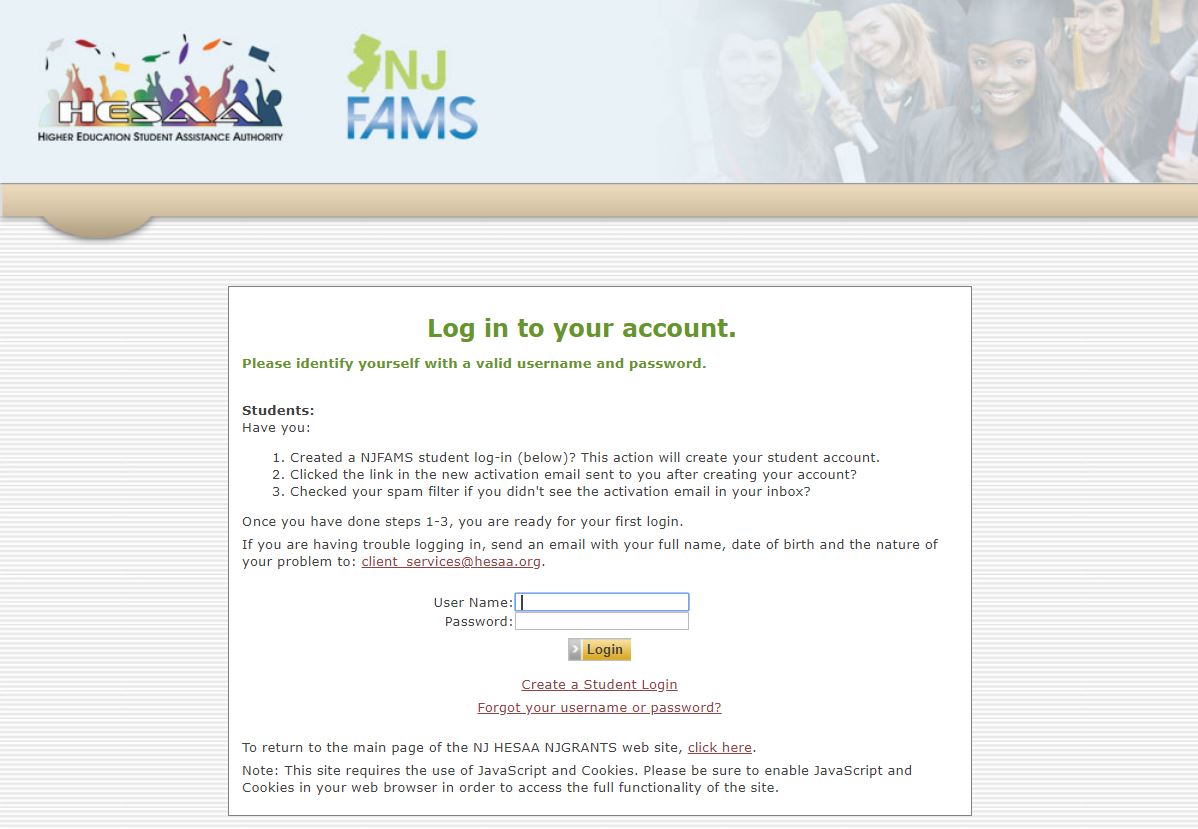

Just like the U.S. Department of Education randomly selects students for Federal Verification, the New Jersey Higher Education Student Assistance Authority (HESAA) randomly selected State residents for State Verification. Unlike federal verification, where the Office of Financial Aid collects and audits additional information on behalf of the federal government, state verification is completed by HESAA.

Log on or create an account at njfams.hesaa.org to view any outstanding items in your To Do List.

View Your To Do List

Visit stockton.edu/verification for instructions on how to create an account.

Once you've been accepted and participate in Orientation and Registration, you will be able to view your bill. Student bills are viewable within the Bursar tab on goStockton portal.

View the instructional video to the right to learn how to view your bill.

Please note: To view an estimate of your bill, visit stockton.edu/bursars.

Once all requirements are completed and enrollment criteria are met, all financial aid will be applied to student bills.

Students are responsible for any outstanding balance reflected on their bill. See below for additional ways to cover your balance.

View Your Bill

Instructional Video:

For additional questions regarding billing or how to use your financial aid to purchase books, visit stockton.edu/bursars.

Don't miss out on any updates! The Office of Financial Aid sends important notifications and correspondence through email. In some cases, action may be required. In other cases, emails are informational. Please check your goStockton email account regularly for financial aid updates.

View Your Email

Additional Ways to Pay

Scholarships are a great way to help pay your bill! Our office provides students with a resource to search for scholarships to help fund their education.

Explore institutional as well as private scholarship opportunities through our Scholarship Resource Center.

Follow @stocktonfinaid on Twitter for additional scholarship opportunities!

View Scholarships

We understand that you may need additional time to pay the full amount of your bill. The Bursar's Office at Stockton University offers students several payment plan options to help accommodate these needs.

Students may enroll in an interest-free payment plan and make installment payments rather than paying the total amount due in one payment. There is a non-refundable enrollment fee to enroll in a payment plan.

The payment plan payment amount is determined by dividing the total amount due (including the enrollment fee) by the number of payment plan payments.

View Options

To help fill the gap with additional funds to cover your educational costs, in addition to any Federal Direct Loans offered to you as a result of filing the FAFSA, we have provided you the opportunity to explore the different types of education loans to see which option(s) may work best to fit your needs.

Parent Direct PLUS Loan:

Parents of dependent undergraduate students are eligible to borrow a Parent Direct PLUS Loan up to the cost of their child's attendance minus other financial assistance. The loan is credit based and interest is a fixed rate.

Apply Now

Private/Alternative Education Loans:

Private/Alternative Education Loans are non-federal government loans offered by private lending institutions as an additional source of funding for higher education.

View Lenders

More Information

Military & Veteran Education Benefits:

Are you a veteran or currently in the Reserves or the Guard? You may be eligible for Post 9/11 or Chapter 1606 educational benefits. Veterans with a 10% or more service connected disability, may be eligible for the VA Readiness & Employment Program. Children and spouses of veterans who are 100% disabled or deceased as a result of being in the military service may also be eligible for educational assistance. Veterans benefits may be available to graduate students if the student is a veteran or currently in the Reserves or National Guard.

Learn How to Utilize Benefits

Financial Aid Appeals:

We realize that there may be cases where your financial situation may have changed substantially and is now very different from the information you reported on the FAFSA. In other cases, a unique circumstance may also exist financially or relating to the dependency of a student. Below are the different types of financial appeals our office will review. If you meet any of the criteria for one of these appeals, follow the directions to submit your appeal to our office.

The FAFSA uses your family’s annual income from two years ago to project how much your family can afford to contribute toward your expenses while you attend college. This projection assumes that family income is relatively stable over the course of time. Federal law allows authorized officials in our office to make certain adjustments to your income data so that it accurately reflects your family’s situation. Learn about eligibility and how to submit an income adjustment appeal below.

Learn More

Federal student aid programs are based on the concept that it is primarily your and your family’s responsibility to pay for your education. Dependent students are required to report parental information on the FAFSA; however, some student situations will require extra discretion in determining their ability to provide this information. Our office provides the opportunity for students to appeal their FAFSA Dependency Status by submitting documentation of their situation. Complete our dependency status review form below, so that we can determine if you may be eligible for a dependency status review.

Learn More

Financial Aid FAQ's:

Click here for a list of frequently asked questions that our office receives as well as answers to these questions. Feel free to review our website for more information as well as for helpful links and resources.

FERPA

Many times, a student's parent or other person may want to speak to our office about a student's account.

Students who want to designate a proxy (parent or other person) to view specific educational records should go to the Proxy Management link in the goPortal. The Proxy Managagement link is in the Student Services tab under Student Tools.

We are unable to speak about a student's account with anyone that has not designated as a proxy.

Stay Up to Date:

Follow us on Facebook, Twitter and Instagram @stocktonfinaid to stay informed with the latest financial aid tips, tricks and information.

Contact Us!

Need more information? Have questions?